Health taxes on tobacco, alcohol, and sugar-sweetened beverages (SSBs) are an essential policy tool for protecting the public from products that drive non-communicable diseases (NCDs), while also raising vital revenue to support health systems and other essential services.

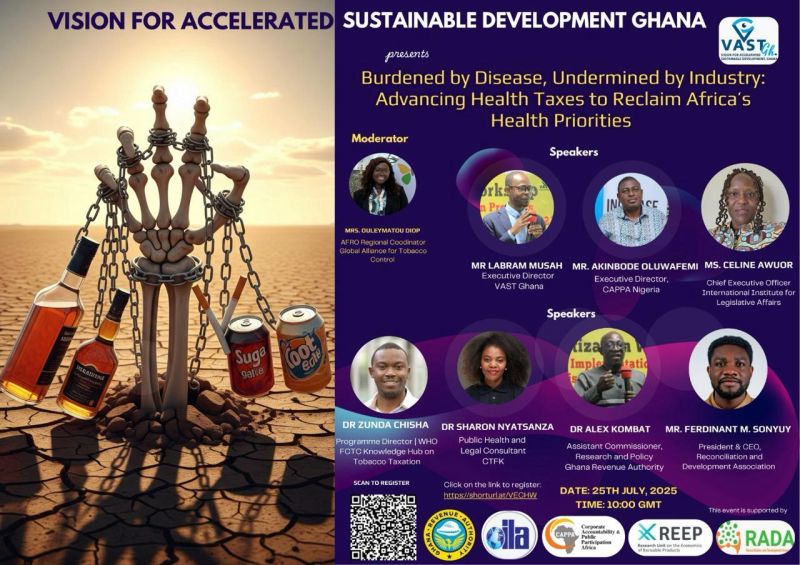

IILA is proud to announce that CEO Celine A. was among the expert speakers at a regional webinar on excise taxation and public health, scheduled for 25th July 2025 at 10:00 AM GMT. The event will bring together leading voices from across Africa to share lessons, experiences, and strategies on how governments can harness excise taxes to save lives and build sustainable public finance systems.

Organized in collaboration with regional and international partners, the webinar will explore:

The public health rationale for taxing harmful products.

How health taxes can reduce consumption and protect vulnerable communities.

Case studies of industry interference in tax and health policymaking.

Policy recommendations for countries advancing fiscal reform.

Celine will highlight IILA’s evidence-based approach to advocacy, including recent policy proposals presented to the Kenyan Parliament calling for increases in excise taxes on tobacco, alcohol, and SSBs, and the reinstatement of inflation adjustments to sustain their impact.

This timely conversation underscores IILA’s leadership in shaping fiscal policies that promote long-term public health and economic resilience.